Navigating the Market: How Scrap Copper Prices Fluctuate

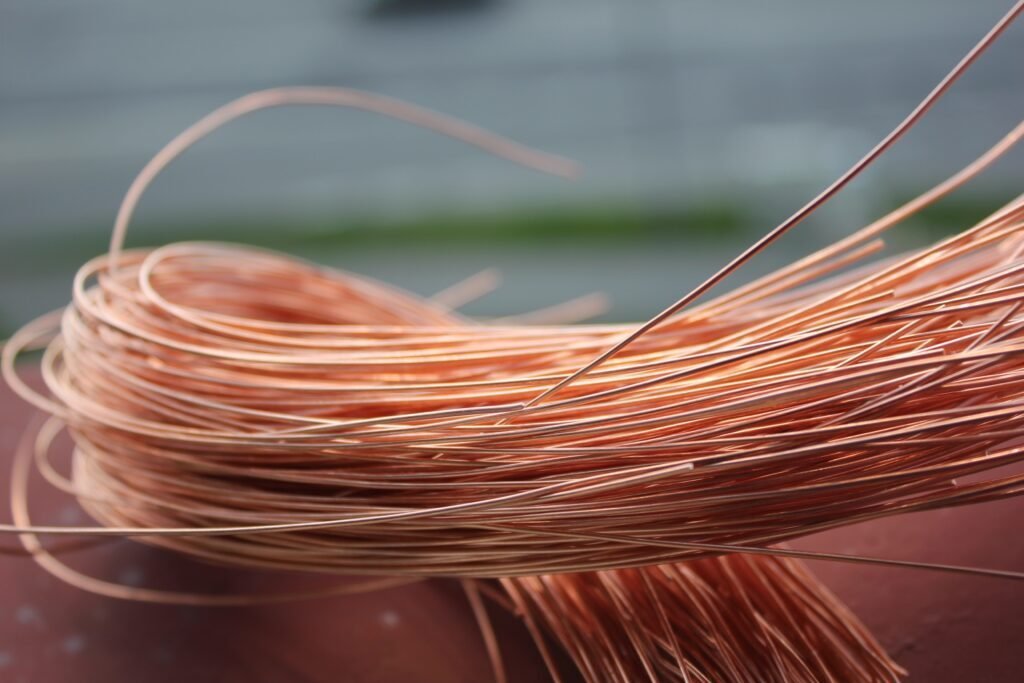

In the dynamic landscape of commodities trading, few elements garner as much attention and speculation as copper. Renowned for its conductivity and versatility, copper serves as a fundamental component in various industries, from construction to electronics.

However, understanding the intricate dance of supply and demand that governs scrap copper prices Melbourne is essential for those navigating this market.

The Foundations of Scrap Copper Pricing

At its core, the pricing of scrap copper reflects the intricate interplay of numerous factors, both local and global. While the laws of supply and demand exert their influence, several other elements contribute to the volatility witnessed in copper pricing.

1. Global Economic Trends: Copper demand often mirrors the overall health of the global economy. During periods of growth and infrastructure development, such as the construction boom in emerging markets, the demand for copper surges, propelling prices upward. Conversely, economic downturns can lead to reduced demand and subsequent price drops.

2. Industrial Consumption: The industrial sector accounts for a significant portion of copper consumption. Sectors like electronics, automotive, and construction heavily rely on copper for wiring, piping, and manufacturing components. Fluctuations in industrial activity, driven by technological advancements, consumer demand, or regulatory changes, directly impact copper prices.

3. Currency Exchange Rates: As a globally traded commodity, copper prices are also influenced by currency fluctuations. Changes in exchange rates between major currencies, such as the US dollar and the euro, can affect the purchasing power of international buyers and sellers, thereby influencing copper pricing dynamics.

4. Political and Geopolitical Events: Geopolitical tensions, trade disputes, and policy decisions can disrupt copper supply chains and production, leading to price volatility. Political stability in major copper-producing regions, plays a crucial role in shaping market sentiment and pricing trends.

5. Environmental Regulations: Environmental policies aimed at reducing carbon emissions and promoting sustainable practices have the potential to impact copper mining and recycling operations. Stricter regulations may increase production costs or limit supply, affecting prices in the long term.

The Role of Scrap Copper Recycling

In recent years, the importance of recycling in the copper market has grown significantly. Recycling not only conserves valuable resources but also mitigates the environmental impact associated with copper mining. Scrap copper recycling serves as a vital source of secondary supply, supplementing primary production from mines.

The recycling scrap copper prices Melbourne process involves collecting scrap copper from various sources, including electrical appliances, construction materials, and industrial machinery. This scrap is then sorted, processed, and melted down to produce high-quality copper ingots or cathodes, which can be reintroduced into the manufacturing supply chain.

Strategies for Navigating Scrap Copper Price Fluctuations

Given the inherent volatility of the scrap copper market, businesses and investors must employ strategic approaches to manage risk and capitalise on opportunities. Here are some

key strategies for navigating scrap copper price fluctuations:

1. Stay Informed: Regularly monitor market trends, industry news, and economic indicators to anticipate changes in copper prices. Leveraging reliable sources of information and market analysis can help stakeholders make informed decisions.

2. Diversification: Diversifying sources of copper supply and customer base can mitigate the impact of price fluctuations. Establishing partnerships with multiple suppliers and exploring alternative markets can enhance resilience in the face of market volatility.

3. Risk Management Tools: Utilise risk management tools, such as futures contracts, options, and hedging strategies, to protect against adverse price movements. These financial instruments allow market participants to lock in prices or hedge against future price fluctuations.

4. Focus on Efficiency: Enhancing operational efficiency and optimising production processes can help mitigate the impact of rising input costs, including copper prices. Implementing measures to reduce waste, improve energy efficiency, and streamline logistics can enhance competitiveness in the market.

5. Long-Term Perspective: Adopt a long-term perspective when making strategic decisions in the copper market. Recognise that short-term price fluctuations are inevitable but focus on underlying demand trends, technological advancements, and sustainable practices that shape the future of the industry.

In the intricate world of commodities trading, navigating scrap copper price fluctuations requires a blend of market insight, strategic planning, and risk management. By understanding the diverse factors that influence scrap copper prices Melbourne and embracing recycling as a sustainable solution, stakeholders can effectively adapt to changing market conditions and capitalise on opportunities for growth and innovation.

As the global economy continues to evolve, the resilience and adaptability of businesses in the scrap copper market will remain essential for long-term success.