Beyond Financial Aid: Leveraging Personal Loan Apps for Education

Education is more accessible yet often more expensive. Technology offers new solutions as students and parents seek innovative ways to fund academic pursuits. One such advancement is the personal loan app for education, a tool that provides financial support beyond traditional student loans or scholarships. These apps simplify securing funds for educational expenses, making them a valuable resource for those aiming to invest in their future without financial constraints.

Embracing Technology for Educational Funding

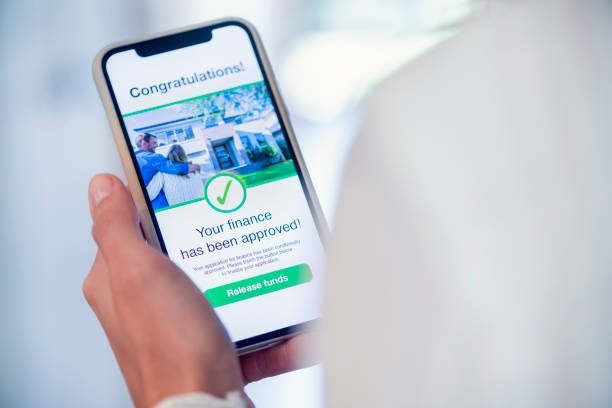

The advent of personal loan apps for education has transformed the landscape of educational funding. Unlike traditional loan processes, which often involve lengthy paperwork and extended approval times, personal loan apps streamline the experience. Students or parents can apply directly from their smartphones, receiving quick decisions and even quicker disbursements. This immediacy can be crucial for meeting urgent tuition deadlines or unexpected educational expenses.

Advantages of Personal Loan Apps for Education

Easy Access to Funds

Personal loan apps are designed for convenience, offering a swift and straightforward application process. Users can fill out their applications, upload necessary documents, and get approved quickly. This accessibility is particularly beneficial for students who need to secure funds promptly to continue their studies without interruption.

Flexible Loan Amounts

These apps often provide more flexibility in loan amounts than traditional educational loans, allowing borrowers to request exactly what they need. Students can tailor the loan to meet their specific financial gaps, whether it’s for semester fees, textbooks, or living expenses.

Competitive Interest Rates

Many personal loan apps offer competitive interest rates compared to traditional bank loans. By shopping around within the app, users can find the most cost-effective borrowing options, potentially saving money over the loan’s lifespan.

How Personal Loan Apps Work

Using a personal loan app is simple. Applicants download their chosen app, fill in personal and financial details, and submit their application. The advanced algorithms assess creditworthiness quickly, and if approved, funds are typically disbursed directly to the user’s bank account. This process eliminates the need for in-person bank visits, making it ideal for busy students.

Building a Smarter Future

Beyond mere convenience, these apps often include features to help users manage their loans effectively. From flexible repayment plans to reminders and budgeting tools, these apps lend money and help borrowers manage their finances responsibly. For students, learning to handle debt wisely is an invaluable lesson that extends well beyond their education.

Conclusion

Personal loan apps for education represent a significant shift in how students and families manage educational expenses. These tools provide necessary financial resources and empower users with greater control over their financial futures. By leveraging technology, borrowers can overcome financial barriers and focus on what truly matters—achieving their educational goals and paving the way for a successful future.