How To Check PTA Tax- PTA Tax Calculator

So, you’ve finally gotten your hands on that hyped-up new phone you’ve been eyeing. Congratulations! But before you start showing it to your friends and exploring all its features, there’s one crucial step you need to take: Yes, you got it right! Check your phone’s PTA approval status online. Register your device and pay the PTA Mobile tax if it is non-PTA.

This blog post will share all the essential information about PTA Mobile tax in Pakistan and introduce you to a handy tool – the PTA Tax Calculator.

But first, let’s find out what a PTA Tax is.

What is PTA Tax?

Taxation is vital in boosting a country’s economy and raising people’s living standards. The Pakistan Telecommunication Authority (PTA) imposes a tax on all mobile phones imported into the country, whether new or used. This tax is mandatory for phones used for more than four months. Paying this tax ensures your phone functions legally on Pakistani networks like Jazz, Zong, etc. You can reap the full benefits of your zong internet packages.

The mobile tax is significant in the fiscal landscape for several reasons:

- It ensures that everyone with a mobile device contributes fairly to the state’s resources.

- Taxing mobiles helps to keep the industry in check, ensuring a good balance between demand and supply.

- The taxes collected from mobiles can boost economic growth, which is great for everyone.

- It provides the financial support for the governance needed to maintain the mobile communication networks.

- It aims to ensure the tax burden is fairly shared among different income groups.

How Much is the PTA Tax?

The PTA tax amount varies from phone to phone and depends on the value of your phone. Generally, it falls within 17%-32% of the declared value. However, keep in mind that the tax amount varies for registration via Passport and registration via CNIC. The price of a mobile phone model may vary depending on the city and online shopping websites you are buying from. The PTA Mobile tax amount for registering your phone depends on its price. Here are the latest rates of PTA mobile taxes in Pakistan.

| Mobile Phones having C&F value (USD) | Fixed-Rate (Amount in PKR) |

| Up to 30 | 1,230 |

| Above 30 and up to 100 | 6,400 |

| Above 100 and up to 200 | 17,280 |

| Above 200 and up to 350 | 23,800+17% GST |

| Above 350 and up to 500 | 34,000+17% GST |

| Above 500 and up to 700 | 52,000+17% GST |

| Above 700 | 60,000+17% GST |

Calculating the exact amount is a bit tricky. Here’s where the PTA Tax Calculator comes in!

PTA Tax on iPhone

The iPhone craze seems never to fade. We usually pair our phones with smartwatches, leading to increased demand for smartwatches in Pakistan. So, for you guys, here is the PTA mobile tax list showing the payable taxes on various iPhone models.

iPhone 11 PTA Tax in Pakistan

Here is a PTA Tax rate list for iPhone 11 Models.

| iPhone 11 Models | PTA Mobile Tax on Passport | PTA Mobile Tax on CNIC |

| iPhone 11 | Rs67,308 | Rs86,689 |

| iPhone 11 Pro | Rs93,180 | Rs115,148 |

| iPhone 11 Pro Max | Rs96,860 | Rs119,196 |

iPhone 13 PTA Tax in Pakistan

Here is a PTA Tax rate list for iPhone 13 Models, including the iPhone 13 Pro Max PTA tax.

| iPhone 13 Models | PTA Mobile Tax on Passport | PTA Mobile Tax on CNIC |

| Apple iPhone 13 | Rs.90,800 | Rs.118,400 |

| Apple iPhone 13 Pro | Rs.105,700 | Rs.128,800 |

| Apple iPhone 13 Pro Max PTA tax | Rs.110,400 | Rs.137,900 |

iPhone 15 PTA Tax in Pakistan

Here is a PTA Tax rate list for iPhone 15 Models.

| iPhone 15 Models | PTA Mobile Tax on Passport | PTA Mobile Tax on CNIC |

| Apple iPhone 15 | PKR 107,325 | PKR 130,708 |

| Apple iPhone 15 Plus | PKR 113,075 | PKR 137,033 |

| Apple iPhone 15 Pro | PKR 135,300 | PKR 161,480 |

| Apple iPhone 15 Pro Max | PKR 148,500 | PKR 176,000 |

PTA Tax Calculator 2024

This online tool simplifies the process of calculating your phone’s PTA tax. Here’s how it works:

- Visit the PTA Website: Visit the official PTA website (https://www.pta.gov.pk/).

- Navigate to “Tariffs”: Locate the “Tariffs” section on the website.

- Find the Calculator: Within the “Tariffs” section, you’ll find the PTA Tax Calculator.

How to use the PTA Tax Calculator?

The calculator typically requires you to enter the following information:

Phone Brand: Select the brand of your phone (e.g., Apple, Samsung, etc.).

Phone Model: Specify the exact model of your phone (e.g., iPhone 14 Pro Max, Galaxy S23 Ultra).

Once you enter this information, the calculator will estimate your phone’s PTA tax amount.

Benefits of Using the PTA Tax Calculator

Convenience: Saves you time and effort compared to manual calculations.

Accuracy: Provides a reliable estimate of the PTA tax you need to pay.

Transparency: This helps you make informed decisions before purchasing a new phone.

How to calculate PTA tax on mobile?

Do you know you can easily calculate tax on a mobile phone? All you have to do is download PTA Mobile Tax Calculator 2024 App on your phone. This app is compatible with mobile phones in Pakistan.

You can also find out the mobile tax when registering your Mobile phone with PTA.

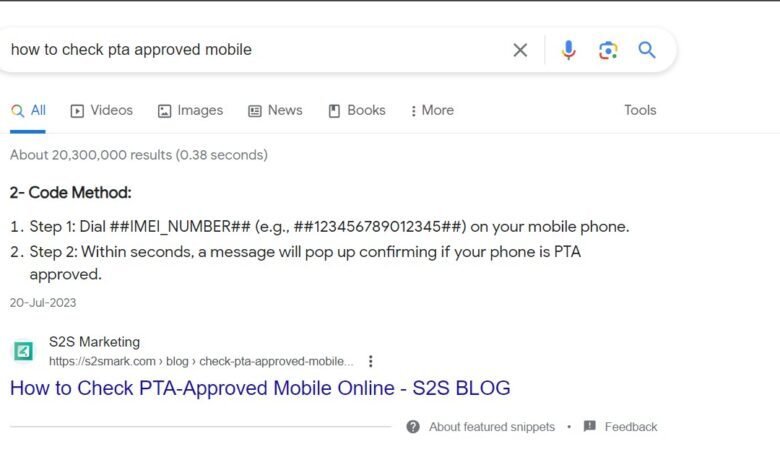

How to register your Mobile Phone with PTA?

Here are the steps to register your device:

- Insert the SIM card into your mobile device.

- Dial *8484#.

- Enter your mobile number, CNIC, and IMEI number.

- Click OK.

Along with other information, you can view the PTA tax amount that must be paid to register your device.

How to pay PTA tax?

Once you know the estimated tax amount, you can pay. Here are the steps to pay PTA mobile tax online:

- Create an account on the Device Identification Registration and Blocking System (DIRBS) website.

- Apply for a Certificate of Compliance (COC).

- Provide the IMEI number(s) of your device.

- Use mobile wallets, ATMs, and bank branches to pay PTA mobile tax online.

Let’s Wrap it Up

Calculating and paying your PTA tax is easier than you think! Just use the official PTA Tax Calculator and the info in this blog, and you’ll be good to go. By taking care of your PTA tax, you can ensure your phone works perfectly on Pakistani networks and avoid any problems. Now, go ahead and enjoy your new phone with peace of mind!